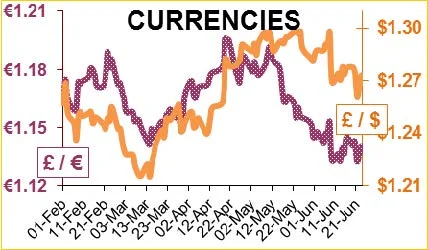

Sterling has been fairly confused this week. The minutes of the previous week’s Bank of England’s MPC showed a 5:3 vote for holding interest rates where they are at 0.25%.

The market was surprised that 3 members had voted for an interest rate rise. £ lifted in response, then Mark Carney tried to calm things down by confirming that there would be no rate rise soon, so £ fell back – or has he just worried pundits that there is division amongst this crucial decision making committee? Just to prove that Mark Carney’s house is divided, the Bank of England’s Chief Economist Andy Haldane admitted that he did consider voting for a rate hike. There will be a bumpy ride ahead on the currency, and not just due to the prospect of the government’s less than secure tenure, and the commencement Brexit negotiations.

As we approach northern hemisphere harvests, weather is beginning to come into play, so that rain on the window pane of a futures exchange can influence prices a little more (but less logically) than rain on crops! Physical wheat prices lifted sharply higher on Monday in response to the £2 rise on Friday on key grain markets. Dry weather has affected crop quality and quantity, particularly in Europe. A US milling wheat futures lifted on concerns about the availability of milling wheat, which when combined with extensive heat in France also lifted the Matiff milling wheat prices.

The UK Liffe exchange slavishly followed the French market despite the fact that it reflects feed wheat prices. Matiff wheat hit 11 month contract highs on Tuesday, only to slide for the rest of the week as forecasts turned wetter in Europe. Reports of more favourable weather in the US mid week saw price come back from the highs set earlier in the week. The rising US wheat prices in recent weeks, culminating in the highs set earlier in the week will also have been influenced by the fact that the big funds have, over recent weeks, significantly squared their positions on wheat and maize. They were shorter (had sold) than they have been for a number of years on these commodities, so to square their positions will have bought back in large amounts of wheat and maize. Perhaps they could not subject their positions to the risk and panic of a weather market?

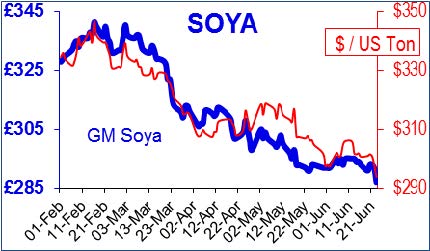

The US has exported 51.8 mln T of soybeans this season up 18% on last year against the USDA's projected 6% increase, the sales would appear to have come at the cost of Argentina whose exports are 23% down on last year.

The Argentinean situation is not being helped by the port workers’s strike, which has been running for over 1 week. The Government has ordered port workers to halt their strike for 15-days and return to the negotiating table. On Thursday’s trading, Soyabeans hit their lowest price in $ since April 2016, at that time our currency was $1.41: £1, so the price of Hipro soyameal in the UK was £272 delivered, whereas now the UK price is £287 delivered, and even then it is benefiting from slightly beneficial freight and crush margins.

Michael Eavis’ first festival at Worthy Farm was the 'Pilton Pop, Blues & Folk Festival' in 1970, which had 1500 visitors who paid the significant sum of £1 per ticket. In 1971 it was a bigger event, having major acts, including David Bowie. After a Hiatus it returned in the 1980s, and has grown with each festival.

This year the Glastonbury Festival returns after a break of a year with over 30 venues, hundreds of acts and an expectation of 140,000 through the gate, paying £238 for a 5 day ticket! The weather has been kind so far, but Sunday is supposed to bring some rain, but hopefully not as bad as 1985 when muck from the dairy farm `washed’ onto the low areas of the site! Rain was a key feature in 1998, and 2005, when two inches fell in 2005, as well as 2007.

Apparently, the look this year is not wellies, but something that baffles me and is apparently called Glitterboobs, and it is a singular look for both men and women.

Regards

Paul Poornan & Martin Humphrey