Currencies

The £ continued to drop this week back to $1.25, a level not seen for 2 years, on the back of cost of living rises and what that means for the economy.

The view is now that £ looks oversold and would likely rebound higher from these levels.

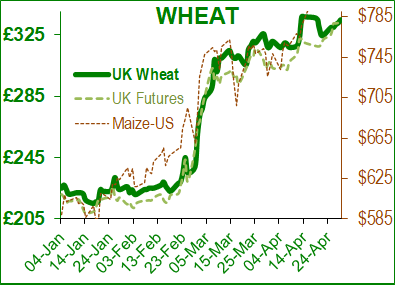

Wheat

Wheat markets continue their rise upwards, especially on old crop now with risk premiums built in for reduced volume in what was an already tight market before the Ukrainian war.

In the UK we are now seeing a very real split between the amount of buyers in the market against the amount of sellers for July old crop position. May futures broke through the £300 barrier this week, an historic high we hoped we would not see.

Looking ahead at new crop, the US weather is improving now looking much cooler and wetter but, crop conditions are currently rated at 27% good/excellent, 22% down year on year! On a positive note though, Russia appear to have resolved their logistics issues and their export figures fir April were up significantly. Although that material will not be coming to the West, it does help to ease the overall global S&D figures.

Ukraine this week announced they expect to produce 70% of their normal crops this coming season which is a phenomenal achievement, given what they are currently facing.

Soya

Soya is down week on week although there is still concern over nearby oilseed tightness in general. Argentina are currently around 30% into their harvest which is about on average and the market feels like it has digested those South American figures now.

Attention is beginning to turn more to the US and the increased acreage planned to be planted their for the coming season.

Organic

With a high proportion of organic raw materials coming from the Black Sea regions, there has been questions raised over the supply chain and if material will be available. We have assurances from our suppliers that material is being stored in large quantities to fulfil existing contracts in the UK already as there was time to prepare. Proteins which largely come from India and China are not affected so their shipping programmes remain the same. The cost of storage and the limited amount of supply though, even before the Ukraine war has meant that prices have reached new highs with organic wheat trading circa £520 per tonne now. There will be significant rises over the coming months which we are doing all we can to communicate to packers and supermarket suppliers.

As we have said before, we understand that this is an extremely concerning time for our customers and we would encourage you to speak to your Sales Representatives to ensure you are getting the maximum performance out of your flocks or if you wish to speak about the raw material markets in more detail, our Procurement and Formulations Manager, Kay Johnson is also available.

Harry’s Farm

Youtube hosts all sorts of interesting information, and occasionally something relevant to what we all need now.

Harry’s Farm is a blog that has been around for a while, but his latest post talks a lot of sense. It is worth watching all the way through – and we wish the retailers did too! https://www.youtube.com/watch?v=O6ws7GKb6ss

If that is not exciting enough, look at Harry’s other channel, Harry’s Garage https://www.youtube.com/c/Harrysgarage

Regards,

Kay Johnson & Martin Humphrey