Currencies

The £ continues to move within that 0.01 range after news that inflation hit 10.4% in February, a small rise when it had been expected that number would begin to fall, followed by the expected news that interest rates have risen to 4.25%.

Wheat

Wheat prices have been largely on the rise this week after testing that £188 level and looking settled around £197, since then we have seen prices increase £20 per tonne before settling back around £203. Most analysts had tipped £200 as the `new normal’ for the foreseeable future, so this correction feels right now and suggests we could now have a period of calm before May contracts expire.

Old crop is still holding a small discount to new crop which is not encouraging farm sales when there is opportunities to sell but the market is so awash with physical wheat and rolled contracts, that this does not appear to be causing an issue. The next concern will be the July period as with little to no shipping programme, the futures stores will be looking for homes come June and if we continue to look like we are due a 16 MlnT+ new crop, storage will be limited, forcing some of those farmers who are currently holding stock to roll, to sell. If anything, it feels as though downside for new crop is less than the potential downside for old crop.

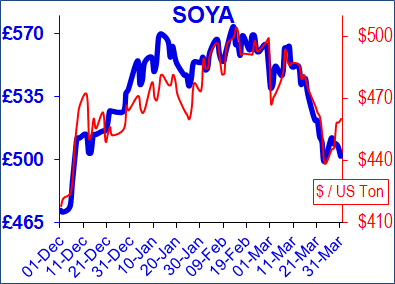

Soya

Soya prices are still making huge daily swings of £10-15 some days which makes forming a long term strategy on proteins difficult. There have been warnings from the US that late heavy snowfall could slow plantings in some areas and the USDA report was seen as bullish with previous end stocks for the US being reduced.

Sunflower origins for the UK look that they will switch back this season from predominantly Argentinian, back to traditional Black Sea material. This is positive in terms of shorter shipping times, however also comes with its own risks as shipments must pass through the Turkish control which has seen huge vessel lines ups. UK shippers will not be holding strategic stock of product this year at the market volatility just does not support that and with a spot to 3 month buying strategy now in the market for most end users, the supply chain does not want to risk holding unsold stock. This will cause short term supply issues and also pricing spikes which need to be considered.

For that reason, we still maintain, holding a spot month by month buying strategy as an end user is risky and adopting a quarterly approach would allow you to take more advantage of these falling markets without the risk of being caught out by short term supply pricing.

Organic

Organic prices continue to drop on old crop as the market struggles to find any real demand. This should switch as we get further out of the winter period and people look to take on summer cover. For new crop though (October onwards traditionally for organic), prices are now starting to hit triggers against conventional which could signal a move upwards. It could work for producers to look at taking out a 12 month feed contract to take some of the benefit of this new crop pricing to see them through the rest of old crop. Speak to your sales Specialist if this is something you wish to look at.

And Finally…

A Woolly Mammoth Meatball Anyone?

Vow, an Australian Cultivated Meat company has gained a lot of attention creating a `mammoth meatball as a project. The objective was to highlight the potential of meat grown from cells, without having to slaughter any animals. The company wanted to ensure that everyone knew the link between industrial scale animal production, and the demise of wildlife, and habitats, and its impact on climate change.

Vow had investigate d the potential of producing meat from more than 50 different specials, most of them still current animals, but using DNA sequence from mammoth myoglobin, from an extinct animal has gathered them some attention, as it was a symbol of diversity loss (nothing to do with ice age, dinosaur extinction then?)

The first commercially cultivated meat is chicken, which is sold in Singapore, and Quail is next, which will soon be marketed in Japan.

Vow worked with Professor Ernst Wolvertang, from the Australian Institute of Bioengineering at the University of Queensland to produce the mammoth protein. The team placed the DNA in Sheep myoblast stem cells, and the meat was relatively easy to produce.

Watch this space…..

Regards,

Kay Johnson & Martin Humphrey